SEPCO-Solar Lighting's Blog on Renewable Energy and Green Ideas

Learn the latest LED solar lighting and power updates, along with practical information to help you design your next project

5 Considerations for Engineers When Specifying Solar Lighting Systems

Solar lighting has matured from niche to mainstream, driven by resilience, sustainability mandates, and ever-improving LED efficacy and controls. Engineers and architects..

Designing Sustainable Urban Spaces with Solar Lighting

Designing sustainable urban spaces demands solutions that meaningfully reduce emissions, improve resiliency, and operate within constrained capital and maintenance budgets...

Blog Recap: The Year 2025 in Review

As 2025 comes to a close, it’s the perfect time to reflect on the ideas and insights that shaped the year in solar lighting and sustainability. From practical tips for keeping..

Let’s Have a Green Thanksgiving

Thanksgiving has evolved over the last couple of generations. It has become more of a time of commercialism and less about giving thanks for all the wonderful things in our lives,..

Why Solar and LED Lighting Make the Perfect Sustainable Pair

Just like milk and cookies, solar power and LED lighting are a perfect combination. They work well with each other while complementing their best attributes to create a solution..

Efficiency and Savings: Benefits of Solar-Powered LED Lights

In today's competitive business landscape, illuminating your outdoor spaces isn't just about visibility; it's a smart investment in efficiency and savings. Commercial outdoor..

The Role of Solar Lighting in a Climate Resilient Future

As the world grapples with the pressing challenges of climate change, the search for sustainable solutions has never been more crucial. One innovative approach gaining momentum is..

How Bright is 7 Watts? Understand Lighting and Brightness

Doing some research, specifically keyword research, I came across this question: How bright is 7 watts? This made me sit back and think. If people are asking how bright 7 Watts..

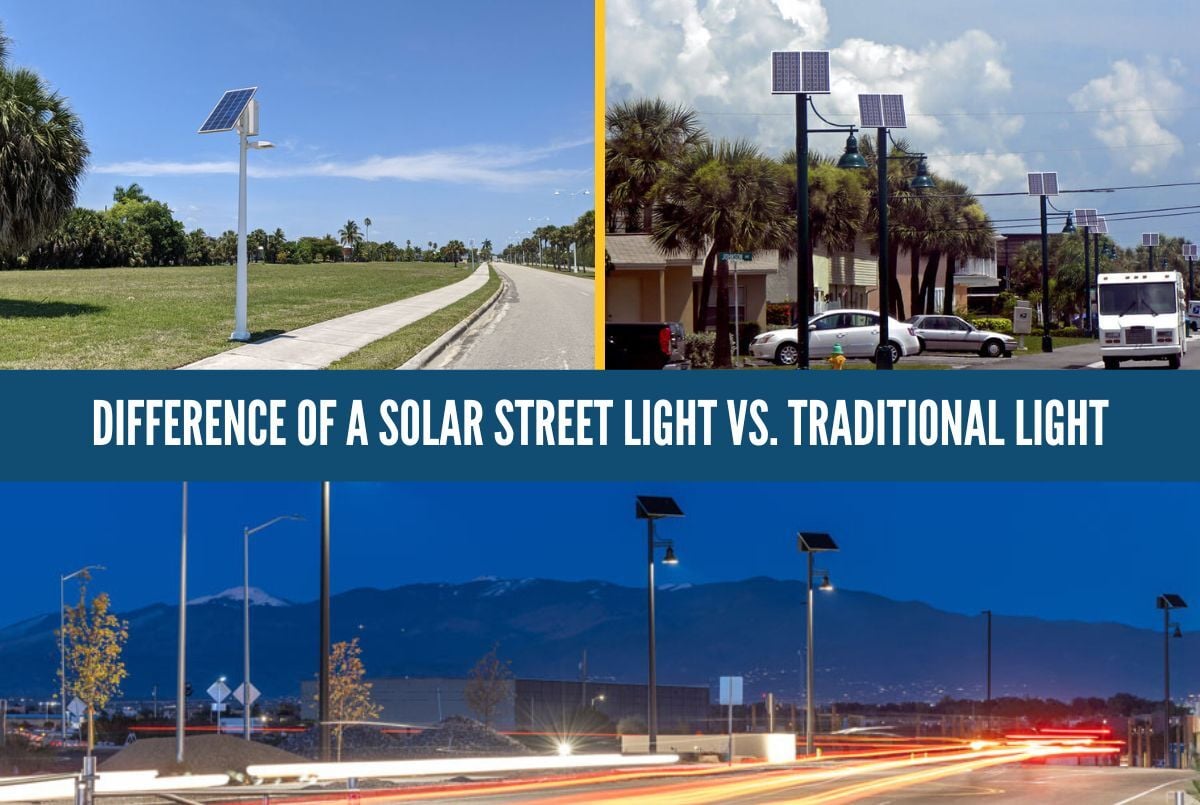

Difference of a Solar Street Light vs. Traditional Light

More cities and communities are making the switch to solar street lights over traditional grid-powered options, and the reasons behind this trend are both practical and..

Why a Minimum of Five Days Autonomy is Important for Solar

When it comes to off-grid solar lighting systems, battery storage is the backbone of reliability. Without enough backup power, lights can go out during extended cloudy periods or..

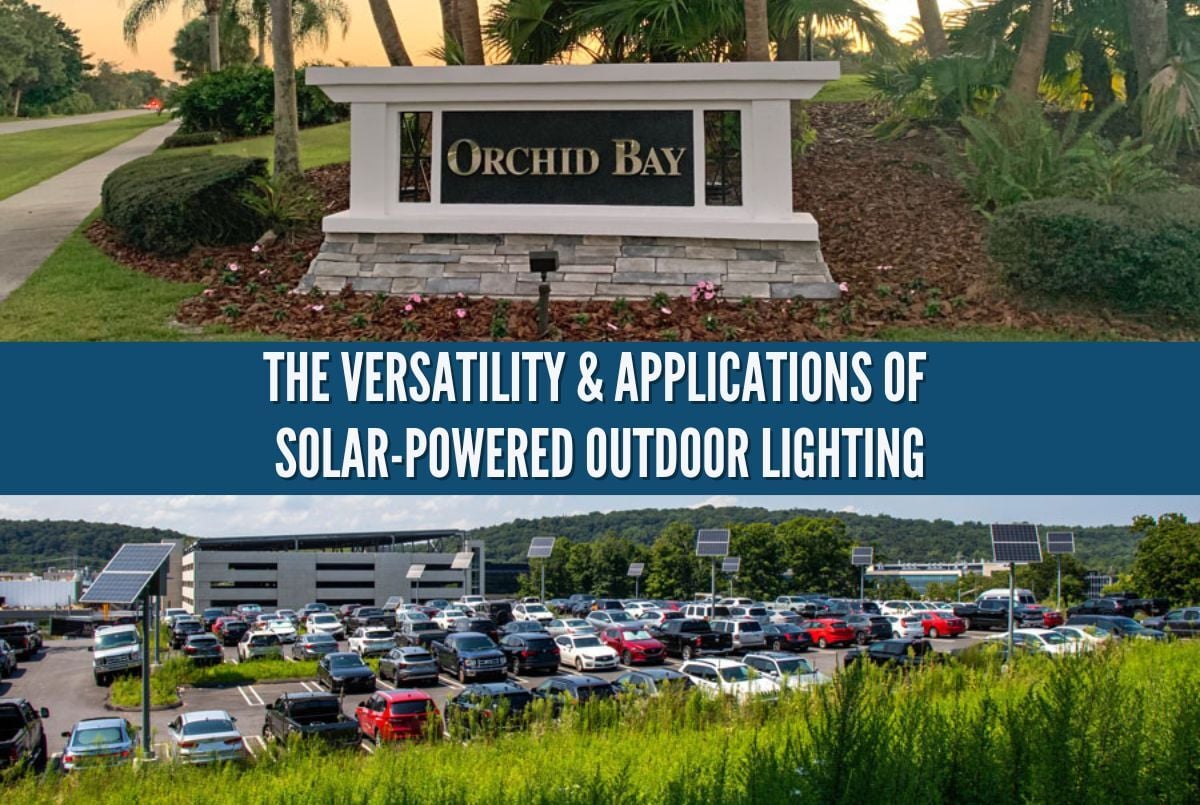

Solar-Powered Outdoor Lighting Solutions for Every Space & Purpose

Solar-powered outdoor lighting has evolved beyond simple pathway lights, offering versatile and efficient solutions for various needs. From enhancing security to beautifying..

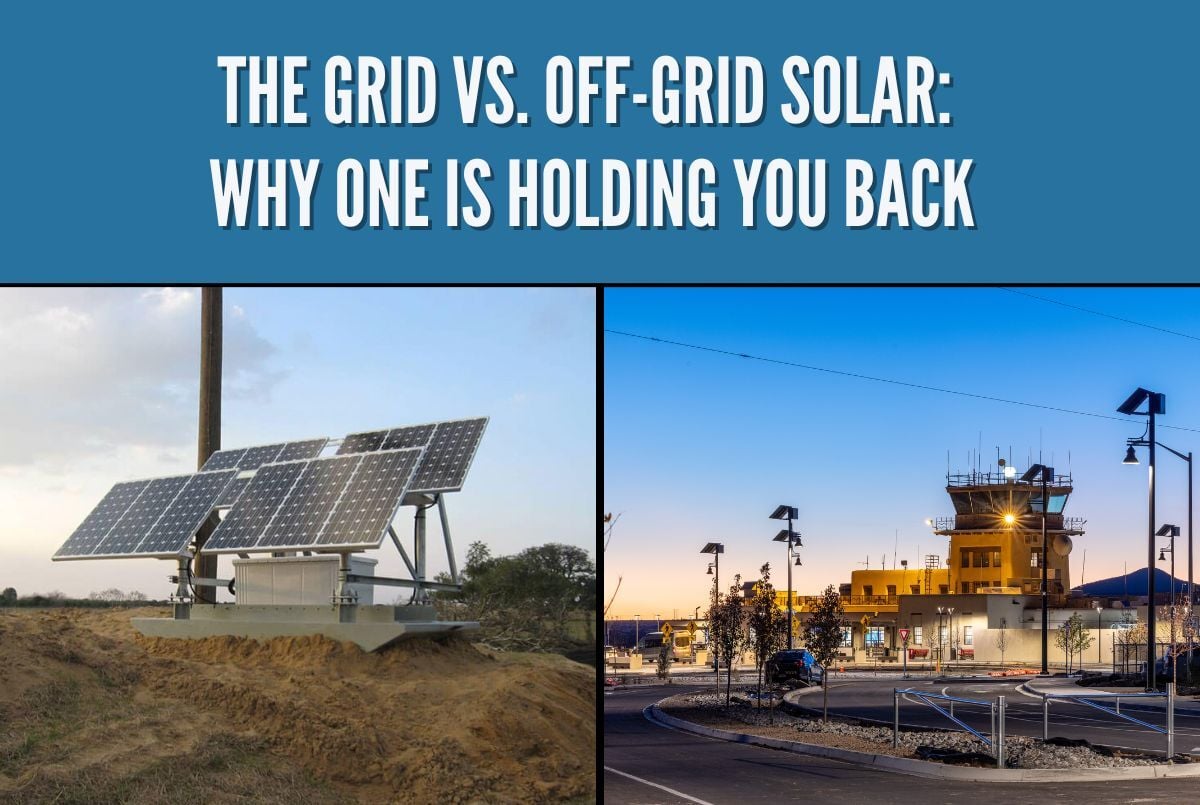

The Grid vs. Off-Grid Solar: Why One Is Holding You Back

In an era of rising energy costs and climate urgency, off-grid solar systems offer a proven solution for true energy independence, delivering resilience, sustainability, and..

Not sure where to start?

Check out our solar lighting design guide and see what it takes to design a commercial solar lighting system